Non-Accruals and Targeting Banks, Making Money on REOs without Buying Them

Right now, it’s a little long to load, but we’re working on that, and you’re going to see some pretty big improvements on that. So if I were to go to, for example, Boston, MA, and now I’m looking at this area, I would say: Show me any banks that have residential first position non-accrual liens.

So one-to-four-family first position non-accrual, and I want to see that they have a minimum of in this case for this particular customer they’re looking for, I think, they said 10 million-plus. So if that’s what you’re looking for, this is how you’d put in a minimum. So I go 200, 2,000, 20,000, 200,000, 2 million. I’ll just make them 5. So show me anyone that’s got 5 million-plus in first position non-accrual loans, and I click “search area.”

You can see from here, we’ve got 10 pages of results. By the way, we have a new interface that is coming out; it’s updated that we are just at the tail end of a right now that is going to make everything really a lot faster and nicer.

So here’s our first list. Now what I can do here if I want to get some more information on here, I can click here. I could say, all right, show me the one-to-four-family first non-accrual. Also show me the 90 plus, and now I’ve got this nice list that I can work from here. The other thing that I can do from here is I can go in, and I can get the contacts right from here.

So I’ll click on this, and here are all the contacts right here. So I think that answers the first question: “What ways can we search for banks and get more information out?” This is one way. If you want to get a bigger area, you just zoom out. We will max you out at some point, and then you search the area again. Let it do its processing, and now we’ve got a bigger list of these folks. So that’s another way to search.

But part of the bigger question here was, the gentlemen said when he looks at this, and he sees that they’ve got, I’m going to go ahead and do it again: one-to-four family non-accrual and 90 plus. He said when he sees that they have these big numbers – here’s 5 million, here’s 2 million – then when he clicks through, he’s not seeing the details on that. This doesn’t mean that all of this is definitely being sold as loans. Some of this will get worked out. Some of this will be foreclosed upon and then resold later as REO. Some of this will be sold as loans. We can see here what these folks have.

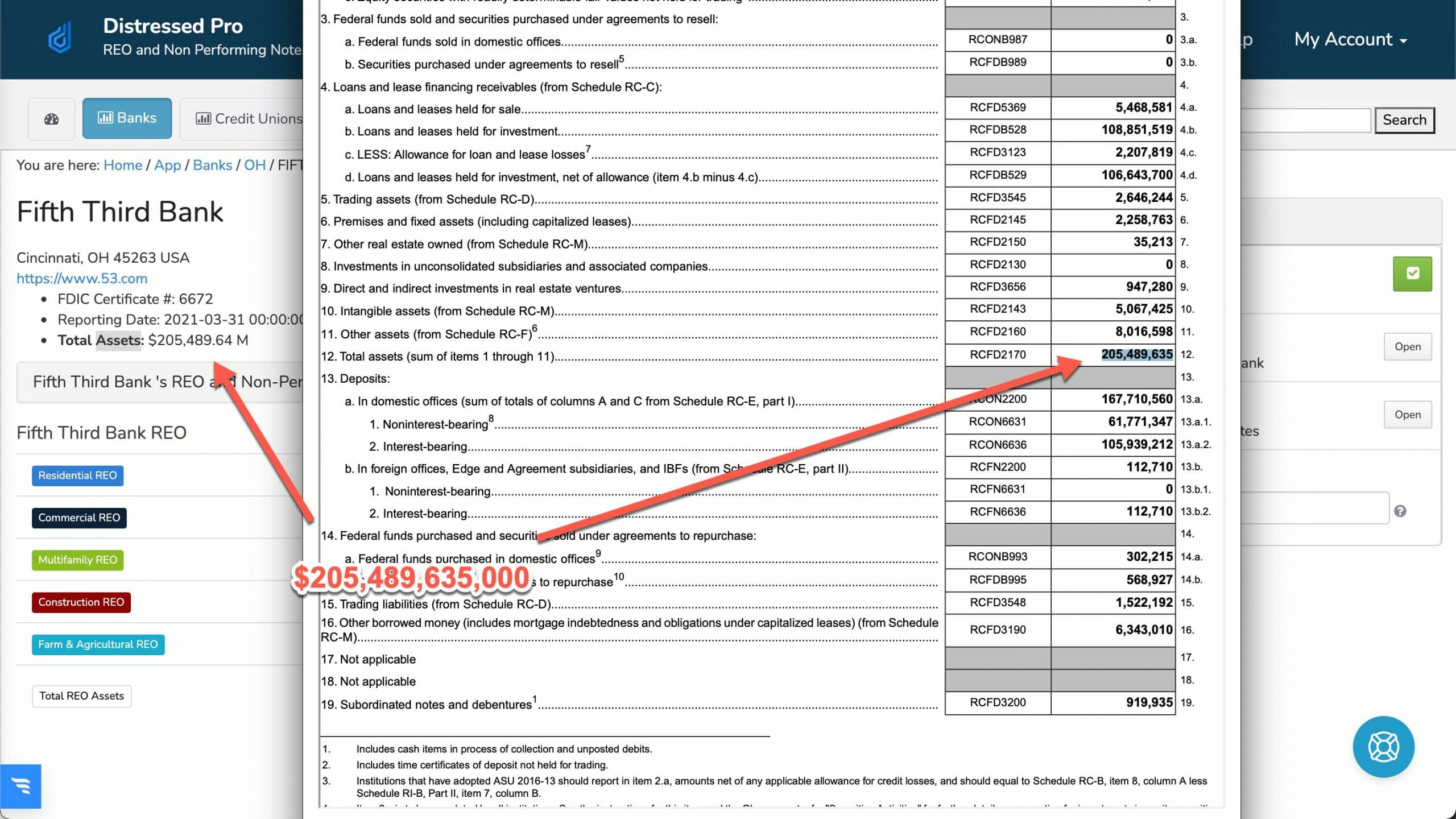

What I’m going to do is click into Fifth Third bank. We’ll go take a look at them. And I’m just going to walk you through the individual records. Again, there’s a big refresh coming with the site. It won’t be completely foreign to you. It will just be faster and cleaner and should give you answers better.

So this top part is all about REO. All about the bank-owned properties. So we can see right now this bank has 3 million in residential REO, 31 million in commercial, six thousand in multifamily REO, 231,000 construction REO for a total of 35.

So when I look at this, I can see here’s what’s been happening over time. Up here for the total assets, this M means millions. It doesn’t mean a thousand. It means millions. So if we were going to go and pull the total assets for Fifth Third Bank, I’ll show you what that is.

As I scroll down, I can see here’s Fifth Third. They’ve got specifically, and they don’t have to have them specifically in the held for sale bucket in order to sell them, but this bank, in particular, is increasing the amount of loans and leases held for sale in the 30 to 89, 90 plus and in non-accrual.

You can see that they’re still a very healthy bank and can afford to take a haircut, and you can see that they are selling non-accrual loans periodically. It’s 37 million, almost 10 million, 42 million. And now, when I scroll down, this is where we get more portfolio data.

So here’s their residential first position loans. And here’s the total size of the portfolio. Here’s the amount of that portfolio that’s late 30 to 89. Here’s the amount that’s late 90 plus. And here’s the amount that’s in non-accrual status. And then right here is the charge-offs. So if we can see way down here, we’ve got these charge-offs, which we put on here as a negative because they draw down on the totals.

You can see that each quarter for this bank anyway, they’re getting more and more late and non-performing loans. And their non-performing loans ratio is now 2.42%. If we look at their junior position loans, this is up at 7%, and that’s over and above what it should be. Okay – 6% is when you start getting into a troubled area, and I wouldn’t be surprised if they’re looking to sell this or have been selling that.

So that is how this works. That’s what these things mean. Here’s the name of the portfolio. Here’s the portfolio total. Each stage 30, 89 90 plus, non-accrual also charge-offs. And then, the calculated non-performing loans to loans ratio, which includes 90 plus day late and non-accrual added together. Take that amount, divide it by the total size of the portfolio. That is how you get the non-performing loans to loans ratio. And that’s what each of these sets of charts is for – each for its own asset types. So you can see here with their owner-occupied commercial real estate loans is really surging.

The way that these work is that these are thousands. So whenever we’re looking at these, they’re either in thousands or millions, and we indicate that with the “M” there. I hope that makes sense. If not, do let us know. And I hope that that answers your questions from here.

You could also do the targeting or the un-targeting. I want to show you one other thing – when you’re on this list, and you go through, and you save these, the other thing that you can do is you can go over to our advanced export, and this might be a decent way for you to get an export of your list.

Once you’ve got everything targeted, go in here, and you call this “my targets,” and we could just go for all the contacts that we have. In fact, that’s what we’ll do. And then this is going to be their headquarters. So we’ll do the city and state. The reason earlier, I showed you this map search, which is what we call the power search, is that this shows you all of the lending areas as opposed to just the headquarters.

So if you’re only looking at Georgia, for example, we’ll zoom in on Georgia. I’m going to search this area.

Okay. So I’ve got 42 banks, and I’ve got 815 locations. That doesn’t mean that they’re all based in Georgia. These all have lending in Georgia. And so that’s the difference between drilling down through this drill down right here, going by all banks and then going over to Georgia and then going to the next step.

That’s only going to be lenders that are headquartered in Georgia, whereas if I’m looking at it here like this, this is all the banks that have a lending presence there in Georgia. I hope that clears it up, and I hope that makes sense. In the end, you will have to speak with these sellers each individually to know exactly where their stuff is.

I hope that answers “where’s non-approval and where is it reflected in the individual bank page?” which, I think were the main questions that was asked through here. And “is there a way to filter when targeting banks?” In that case, this is one of our better options. You also have access to this other one here, which is called “advanced search,” which has similar filters on the side. The difference is that we’re only looking at the headquarters in this one here, which would be the same approach that we have here, as opposed to the entire lending area. Hope that all makes sense for you. I’ll move on to the next one.

I’m not a real estate broker but would like to earn money with REOs. Short of buying them, is there any other way?

Absolutely. There’s wholesaling notes. You can do that just the same way. If you’re not familiar with that, we do touch on that. But wholesaling is the process of finding and tying up an asset and then selling it to a cash investor and baking in a little fee in there.

You can do that within an assignable contract. And there’s a couple of other options. That’s probably the easiest one, but if you don’t have a license and you want to make money with REOS short of buying them, then the best way to do that, I would say, is to do it with assignable contracts.

That’s it. I hope that if you have any questions, you’ll go ahead and ask them here. If you had a question this week and you still need clarification on it, we want to make sure that you’re being productive and you’re getting out of this what you came to get out of it. So definitely do let us know how we can help you with that.

Thanks so much for being a customer. Really appreciate you being here, and I love getting your questions each week. Make it a great day.