BankProspector Credit Union Data Updates: What’s New and What’s Changed

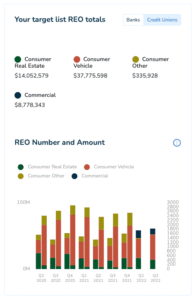

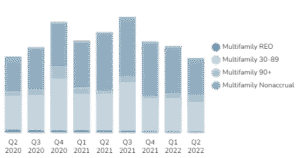

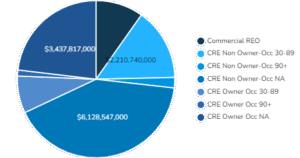

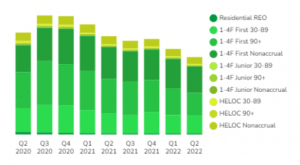

The National Credit Union Administration (NCUA) made some significant changes in 2022 to how credit unions complete the industry’s quarterly call report, and the BankProspector software